Top 9 Financial Scams in Indian History

throughout its history. Unfortunately, the Indian stock market has witnessed numerous frauds and fraudulent activities that have negatively impacted investor confidence and the financial situation across India. In this article, we take a look at the top 9 financial scams in India, their tactics, their impact, and what we can learn from these unfortunate events.

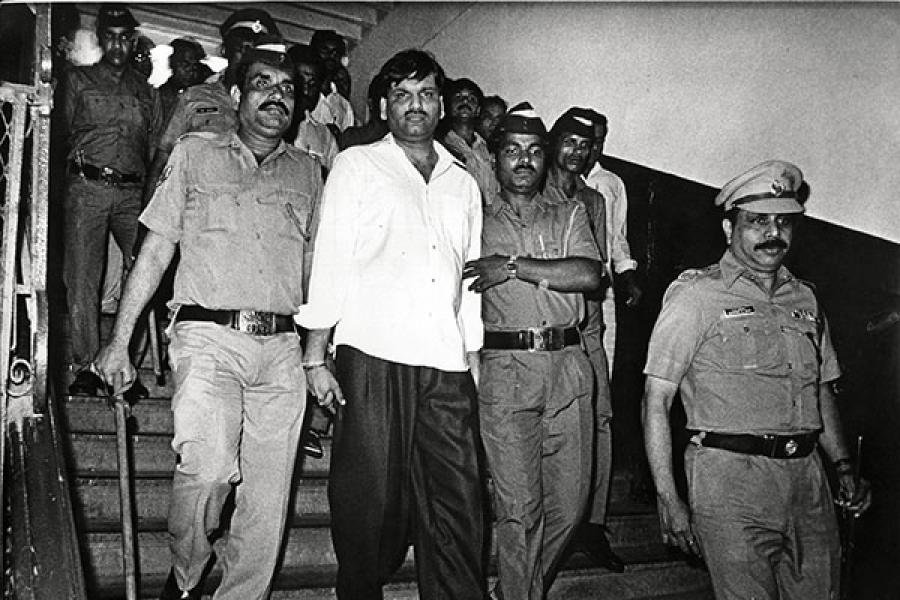

The Harshad Mehta Scam:

the Harshad Mehta Scam, or better known as the 1992 Securities Scam. Harshad Mehta, then a stockbroker, manipulated stock prices through fake bank statements and exploited vulnerabilities in companies. banking system. This move caused the stock price to rise significantly. Then came a crash that cost the market billions of dollars. The aftermath of this fraud has drawn attention to the urgent need for increased regulation and improved oversight in the Indian financial sector.

Satyam Computer Services Scam:

Another major scam worth mentioning is the Satyam Computer Services scam that came to light in 2009. The scandal exposed a large-scale accounting fraud engineered by Satyam Computer Services founder Ramalinga Raju. Raju manipulated financial records to artificially inflate profits. Both shareholders and investors are deceived. This shocking fact caused the Satyams stock price to completely crash. resulting in. The case highlighted key factors such as transparency, corporate governance and thorough auditing as key steps taken to protect investor interests. By thoroughly researching these financial scams and understanding their impact. Valuable lessons can be learned to avoid similar pitfalls in future efforts in Indian financial markets.

Ketan Parekh Fraud:

Ketan Parekh is a well-known stockbroker who organized a market manipulation scheme in the early 2000s. Parekh has used its network of big companies to unnaturally inflate stock prices, especially in the technology and media sectors. The scam was eventually exposed, resulting in a sharp market correction and huge losses for investors. The event highlighted the need for a rigorous regulatory framework and the importance of detecting and preventing market manipulation.

Sahara Group Fraud:

The Sahara Group fraud involved the misuse of funds raised through optional fully convertible debentures (OFCDs) from millions of investors. The group, led by Subrata Roy, promised a high return on capital but failed to deliver on that promise. The Securities and Exchange Board of India (SEBI) stepped in to protect investors’ interests and litigation followed. The fraud highlights the need for robust investor protection mechanisms and strict regulation in the financial sector.

NSEL Fraud:

The National Spot Exchange Limited (NSEL) fraud uncovered in 2013 involved trading in non-existent goods. The exchange allowed trading of pairs contracts, tricking investors into thinking they were investing in physical commodities. The fraud resulted in huge financial losses for investors and led to regulatory reforms in commodity markets. The case highlights the importance of due diligence, transparency and effective oversight in commodity trading.

PNB-Nirav Modi Scam :

The PNB-Nirav Modi scam, which surfaced in 2018, involved fraudulent issuance of letters of undertaking (LoUs) by employees of Punjab National Bank (PNB). These LoUs were used by Nirav Modi, a jeweler, to secure loans from overseas branches of Indian banks. The scam exposed weaknesses in the banking system and raised concerns about risk management and internal controls within financial institutions. It prompted reforms to strengthen the banking sector’s integrity and transparency.

Rose Valley Scam :

The Rose Valley scam, a ponzi scheme that operated between 1999 and 2014, duped millions of investors across multiple states. The group enticed investors to purchase holiday membership plans with the promise of high returns. However, the money collected from new investors was used to pay off older investors, rather than generating legitimate profits. The scam revealed the vulnerability of investors to fraudulent schemes and highlighted the importance of investor education and regulatory vigilance.

SpeakAsia Scam :

The SpeakAsia scam, which emerged in 2011, involved a fraudulent online survey company that promised high returns to participants for completing surveys. The company collected money from investors under the guise of subscription fees, with the intention of running a ponzi scheme. The scam emphasized the need for due diligence and skepticism when dealing with investment opportunities that offer unrealistically high returns.

Karvy Stock Broking Limited Scam:

The Karvy Stock Broking Limited scam, revealed in 2019, involved the misuse of client securities by the brokerage firm. Karvy pledged client securities to borrow funds for its own purposes, contrary to the rules and regulations governing client securities. This unauthorized use of client assets not only violated investor trust but also put their investments at risk. The scam highlighted the importance of strict segregation of client assets and the need for robust monitoring and auditing mechanisms in the brokerage industry. It prompted regulatory authorities to enhance safeguards and reinforce investor protection measures.

Conclusion :

These top 9 Financial scams in India have left an indelible mark on the country’s financial ecosystem. They have exposed vulnerabilities, highlighted regulatory gaps, and reinforced the need for stringent oversight, investor education, and transparency. The lessons learned from these scams have driven reforms in the financial sector, empowering regulators to enhance safeguards and protect the interests of investor. As India moves forward, it is crucial to remain vigilant, learn from the past, and continuously strengthen the mechanisms that safeguard the integrity of the financial market.